51+ is mortgage interest deductible on rental property

Web To deduct mortgage interest you need to fill out line 8a on Schedule A IRS Form 1040 or 1040-SR using Form 1098. Web The deduction can be taken for the expected life of the property but it must be spread out over multiple years Note that the IRS says rental properties can.

Hywztwcoccg7vm

If you receive rental income from the rental of a dwelling unit there are certain rental expenses.

. Instead it is added to Kens basis in the home and depreciated over 275 years. Web Under the new law you can only deduct interest on loans used to purchase build or substantially renovate your home. Web He can deduct the interest hes been charged from 1 April 2021 to 30 September 2021 against his rental income.

Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. Web The deduction is reduced by 10 percent for each additional 1000 of adjusted gross household income phasing out after 109000. Ad Access Tax Forms.

Complete Edit or Print Tax Forms Instantly. Web What Deductions Can I Take as an Owner of Rental Property. Because he acquired the property after 27 March 2021 he.

Your lender will send Form 1098 to you. Discover Helpful Information And Resources On Taxes From AARP. The interest payments Ken makes on the.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web The rental property mortgage interest deduction offers significant tax benefits. Since the rental property is not the property the secures the HELOCLoan the.

Some interest can be claimed as a deduction or as a credit. Web Interest is an amount you pay for the use of borrowed money. Web It follows that any sum of mortgage interest can be written off as a tax deduction.

22 suspends from 2018 until 2026 the deduction for interest paid on home equity loans and lines of credit unless they are used to buy build or substantially improve the taxpayers home that secures the loan. Web We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can make an election to deduct it all on the rental. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web The Tax Cuts and Jobs Act of 2017 enacted Dec. To deduct interest you paid on a debt. Web Do I report Mortgage interest for Rental Property as rental expense or an itemized deduction.

You would need to take. It depends upon whether youre limited on your losses as to whether or not we want to do that. Heres how it works using an example property purchased for 325000 with a.

Mortgage payments are deducted on the first 1 million 500000 for married. But you can deduct the interest on the. Yes you would only enter the balance.

Register and Subscribe Now to Work on Pub 936 More Fillable Forms. Web Up to 25 cash back The 10000 loan amount is not deductible. Married individuals filing separate returns.

526 N Sergeant Ave Joplin Mo 64801 Zillow

Updated For 2023 Everything Ontario Landlords Need To Know About Tax Deductions Liv Rent Blog

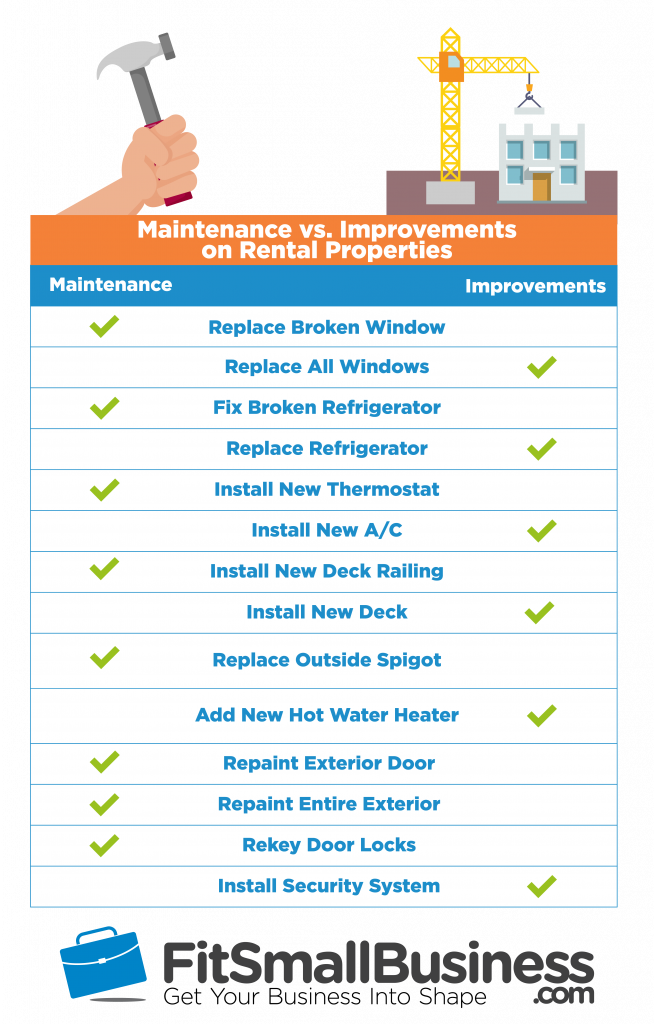

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

83401 Id Real Estate Homes For Sale Redfin

Is Your Mortgage Considered An Expense For Rental Property

Rental Housing Magazine March April 2022 Issue By Rental Housing Issuu

4206 Washington Rd West Palm Beach Fl 33405 Realtor Com

Can I Claim Mortgage Interest On Rental Property 2023 Updated

1505 Avenue C Del Rio Tx 78840 Zillow

2027 S Wall Ave Joplin Mo 64804 Zillow

Rental Housing By Rental Housing Issuu

Governance And Investment Of Public Pension Assets Open

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Oal6yknq Ff9um

2815 N Harding Ave Chicago Il 60618 Mls 11010850 Redfin

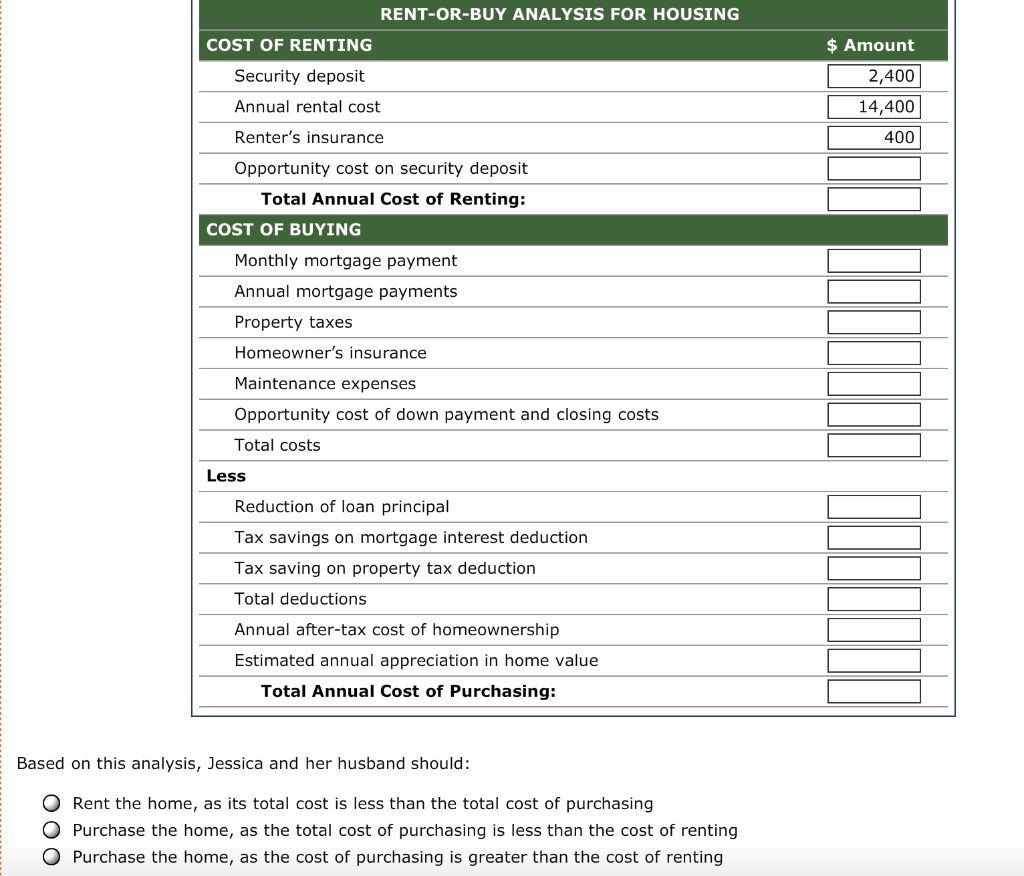

Solved Rent Or Buy Analysis For Housing Cost Of Renting Chegg Com